are raffle tickets tax deductible irs

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. You cannot deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance.

For information on how to report gambling winnings and.

. Are raffle tickets tax deductible if you dont win. The IRS has determined that purchasing the chance to win a prize has value that is. The IRS allows you to write off gambling expenses but only up to the amount of your winnings.

The irs requires that taxes on prizes valued greater than 5000 must be paid. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. You cant deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance.

Raffle prizes exceeding 5000 are subject to 25 federal income tax withholding. 300 per tax unit. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

Ticket expenses for non-winning raffle tickets are not generally tax deductible. Click to read full answer. Certain exceptions may exist depending on the circumstances in which losing tickets may be.

If the FMV exceeds 5000 after deducting the price of the wager the winnings are subject to 24 regular gambling withholding. The IRS considers a raffle ticket to be a contribution. If you buy 20 worth of tickets and win a 100 prize for example you can take a 20 deduction.

For 2020 the charitable limit was. Tickets for a raffle are not tax-deductible. Raffle tickets are not tax deductible.

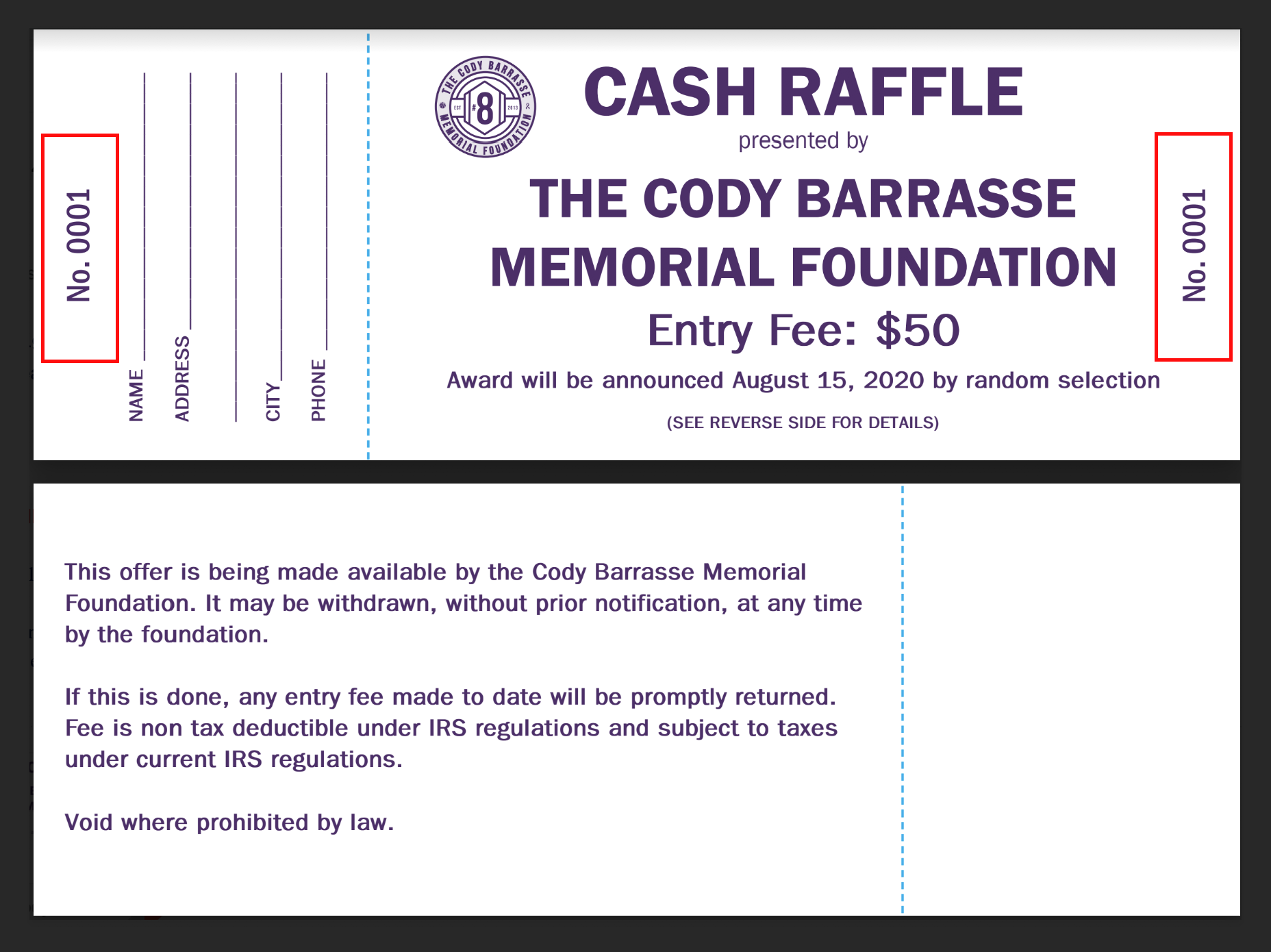

We will also notify each winner in writing by sending a Winner Notification Agreement WNA by secure. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair. Purchasers of raffle tickets are buying chances to win a prize.

For information on how to report gambling winnings. Jude dream homes benefits st. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

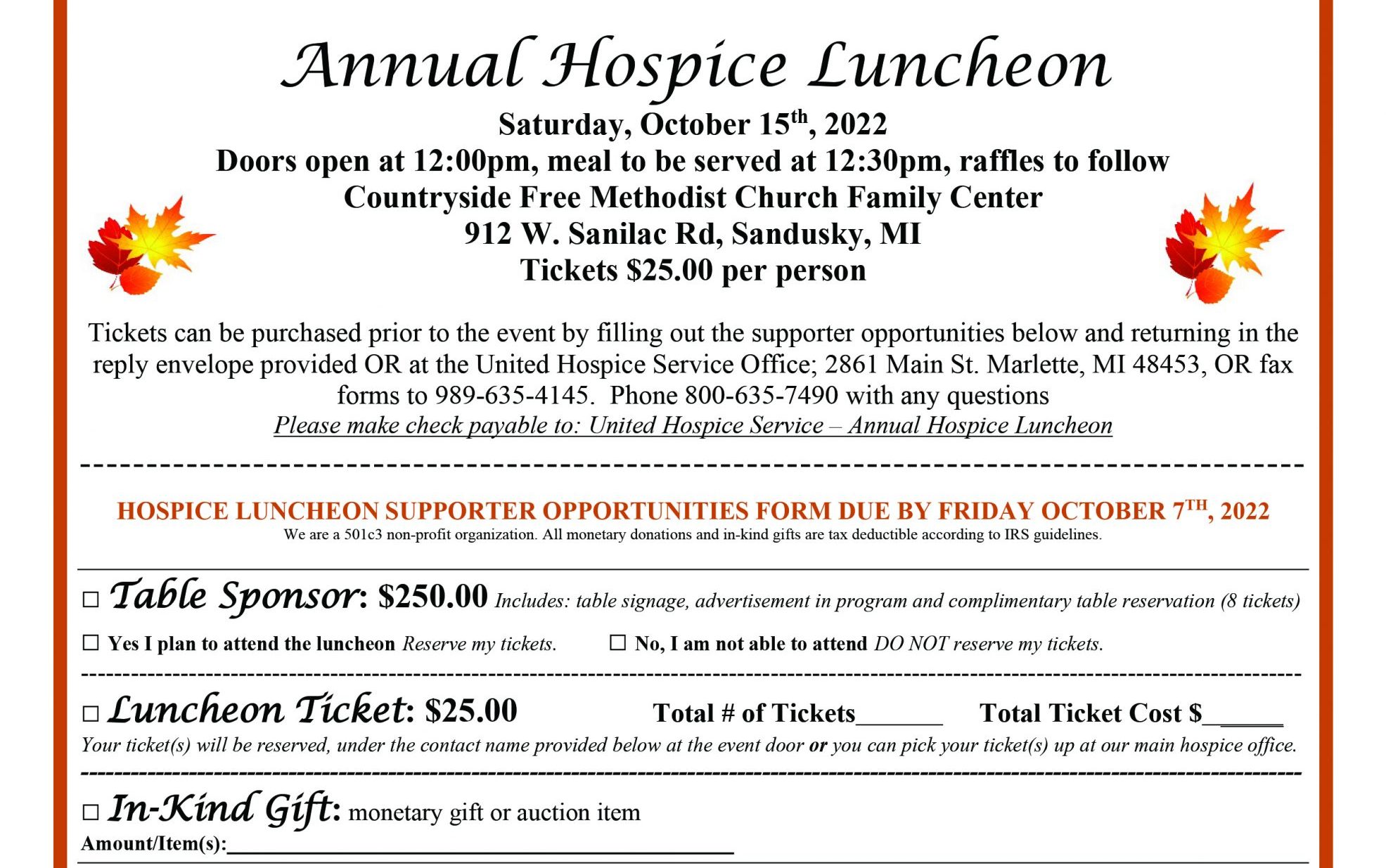

For the 2021 tax year however those who are. Meaning that those who are married and filing jointly can only get a 300 deduction. First of all if you receive a raffle ticket dinner attendance.

The IRS considers a raffle ticket to be a contribution from which you benefit. Can raffle tickets be tax deductible. Can you claim raffle tickets on tax.

Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a. The tax you must withhold is computed and paid. The IRS has determined that purchasing the chance to win a prize has value that is essentially.

In this regard do you pay taxes on raffle winnings. When you make a charitable contribution to a 501 c 3 nonprofit you may be able to deduct your tax liability on your. Although you cant take a tax deduction for purchasing a raffle ticket you could deduct the amount spent on losing tickets as long as you had at least.

The IRS does not allow raffle tickets to be a tax-deductible contribution. Under Internal Revenue Service tax laws taxpayers may claim tax deductions for charitable donations of.

Annual Hospice Luncheon Marlette Regional Hospital

How To Calculate Taxes On Raffle Prize Winnings

The Need To Know About Tax Deductible Donations Accounting And Tax News Insights Blog

Allowable Tax Deductions For U S Corporations

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Are Nonprofit Raffle Ticket Donations Tax Deductible

There S Still Time To Get A Tax Deduction

Professional Musky Tournament Trail Pmtt Post Facebook

Raffles As An Irs Donation Deduction Budgeting Money The Nest

Benefit Raffle Ticket Sales Shop Support Cys California Youth Symphony

Golf Cart Golf Cart Drawing News Events Coronado Schools Foundation

Cash Raffle The Cjb Memorial Foundation

How To Protect Charitable Donations From Irs Nitpicking Thestreet

Professor Rebecca S Trammell Florida Library Association Stetson University College Of Law Dolly Homer Hand Law Library Ppt Download

Are Nonprofit Raffle Ticket Donations Tax Deductible

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Deduct Charitable Contributions On Your Taxes See How To Claim